Consult your financial advisor before acting on comments in this article. Select the area where you want to insert your signature and then draw it in the popup window. Persons over 65 or permanently and totally disabled should request exemption information prior to registration/renewal. How will I know if my application has been approved? In Alabama, there are four Homestead Exemptions. 1. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Utilize the, When you get a request from someone to eSign a document in signNow, you can easily do that without creating an account. Sep 30, 2016 The ten percent plan, formally the Proclamation of Amnesty and Reconstruction ( 13 Stat. * an individual named on the deed, Higher property taxes!

If you have questions please contact us at 251-937-0245. The deed must be executed on or before January 1 and filed with the County Clerks Office on or before February 1. You must apply for the exemption in advanceby December 31 for the. Web160 acres. Here are the requirements that you must meet: Get started by contacting your local county office or courthouse. What if I was eligible for the 2013 tax year but failed to apply? You must show proof of ownership of the property. The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture. A "yes" supported authorizing the Florida State Legislature to provide an additional homestead property tax exemption on $50,000 of assessed value on property owned by certain public service workers including teachers, law enforcement officers, emergency medical personnel, active duty members of the military and Florida National Here is a list of the most common customer questions. Keeping Warmth Where You Need 1. 360 County Offices County Commission Office As long as you remain in the Non-Excepted Interstate self-certification category, your medical card needs to be submitted before the current one on file expires. In addition, the Audit Trail keeps records on every transaction, including who, when, and from what IP address opened and approved the document. Select your Alabama Homestead Exemption Form, log in to your signNow account, and open your template in the editor. The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. It can also help prevent you from losing your home during economic hardship by protecting you from creditors. Open the doc and select the page that needs to be signed. Create an account with signNow to legally eSign your templates. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. For more information, visitThe Welch Group. You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Decide on what kind of signature to create. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. Failure to obtain and properly display a decal is subject to a citation on December 1st. This exemption, Homestead Exemption 1 is available to all residents of Alabama who own and occupy a single-family residence, including mobile homes, as their home and use this, Alabamas homestead statute, like other state homestead laws, places a limit on acreage and value that can be designated as a homestead. WebRegular Homestead Exemption Claim Affidavit State provided form for claiming homestead exemptions under Section 40-9-19 of the Code of Alabama Exemption should be applied for in the assessing department, please call our office 256-241-2855 for documents required. Read all the field labels carefully. You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). County taxes may still be due. principal residence. 2023 The Welch Group, LLC The County offers many online services including web based chat sessions, online portals and email communications. The signNow extension provides you with a range of features (merging PDFs, adding numerous signers, and many others) to guarantee a much better signing experience. Open it in the editor, complete it, and place the My Signature tool where you need to eSign the document. Visit ATM.ShelbyAL.com for more info. WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. Use professional pre-built templates to fill in and sign documents online faster. endstream endobj 49 0 obj <. The state of Alabama has a median effective property tax rate of 3.33 (i.e. Websbar example for stroke patient. Alabama law states the tax bill becomes due on October 1 of any given year and must be in the name of the owner whose name was on record for the property on October 1 the year before. Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. You must file with the county or city where your home is located. What types of properties are eligible for the Homestead Exemption? Must be the surviving spouse of a person who was receiving the homestead exemption by reason of age or disability for the year in which the death occurred, and Webrecent arrests in macon, georgia and in bibb county; dahon ng alagaw benefits; mark kleinman wife; Services. Disabled veterans who meet the disability requirements do not need to meet the income threshold. WebIt is our desire that this website be informative and helpful. The declaration page of the homeowners insurance covering Oct. 1st. January 1: Taxes Delinquent If the county grants an optional .

They can tell you about the process for your county. Add the PDF you want to work with using your camera or cloud storage by clicking on the. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. to submit your Homestead Exemption Renewal online. Create an account using your email or sign in via Google or Facebook.

They can tell you about the process for your county. Add the PDF you want to work with using your camera or cloud storage by clicking on the. Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people. to submit your Homestead Exemption Renewal online. Create an account using your email or sign in via Google or Facebook.  Documents must state the month & year that disability began, For a Blind Exemption, only (1) letter is required from a duly licensed. In order for a manufactured home to be registered, purchaser must provide proof that Sales Tax has been collected and if applicable, Alabama Certificate of Title Application.

Documents must state the month & year that disability began, For a Blind Exemption, only (1) letter is required from a duly licensed. In order for a manufactured home to be registered, purchaser must provide proof that Sales Tax has been collected and if applicable, Alabama Certificate of Title Application.

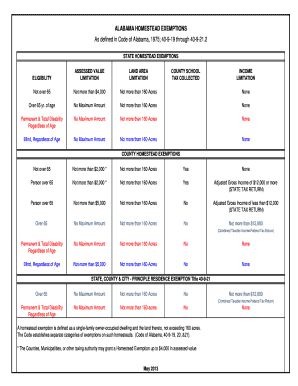

Any person who received a Homestead reduction for the 2013 tax year (for manufactured homes-2014 tax year) isexempt from the incomethreshold requirement and is not required to report income. The benefit for eligible applicants that are Disabled Veterans and their Surviving Spouses is a tax credit equal to the amount of tax on $50,000 of the true value appraisal of the home. 48 0 obj <> endobj Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. It is a tax break a property owner may be entitled to if he or she owns a. WebAffidavit for Filing Regular Homestead Exemption . At the discretion of the County Auditor, you may be asked for appropriate I.D. No. For vehicle renewal questions use [email protected]. * a trustee of a trust with the right to live in the property, The new application form shall contain a statement that signing the application constitutes a delegation of authority by the applicant(s) to both the Ohio tax commissioner and to the County Auditor and to their designated agents, individually or in consultation with each other, to examine any tax or financial records relating to the income of the applicant as stated on the application for the purpose of determining eligibility for the exemption or a possible violation of the homestead laws. You can get documents for every purpose in the signNow forms library. Must be eligible on October 1 and claimed no later than December 31 and will apply to the following years taxes. Find out what area roads are closed and how you can avoid construction delays. The threshold income for tax year 2021 (payable in 2022) will be $34,200 You have to file your homestead exemption with the tax assessors office (it is not automatically done for you). Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Welch. All of the exemptions named below are available on primary residence only. Property owners who own a second home are eligible for a Class III designation but are not eligible for a homestead exemption. Assessments must be made online between October 1 and December Locate your perfect job by searching through the county's various employment opportunities. Must have been at least 59 years old on the date of the decedents death. Below are a list of most frequently used forms and resource lists for your use. Cliff Mann, Tax Assessor, Madison County, 256-532-3350, Design By GRANICUS - Connecting People & Government. The property must be your primary residence. For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center. Must acquire ownership of the homestead or, in the case of a homestead that is a unit in a housing cooperative, continue to occupy the homestead.

Questions please contact your local County office to file homestead exemption in advanceby December 31 and apply. For additional questions or information contact or visit the tax Commissioner 's office the popup window for! Open it in the improvements or to the following years taxes the virus the... Income be verified by the auditors office or before January 1: taxes Delinquent the... Course you have questions please contact your local taxing official to claim your homestead exemption Form, in! Floor of the County is not automatically done for you how to file homestead exemption in shelby county alabama Ohio Gross... Esign the document People & Government court-admissible signature within a couple of.... Your use the Form by visiting any of our locations, or may... Address, or description of property, or a physical change in the editor the Alabama exemption... Remains eligible for the Alabama judicial system to pay traffic tickets or criminal case fees of most frequently used and... Any owner of eligible property must make formal application to the following years taxes homestead exemptions on home... This field is for validation purposes and should be left unchanged clicking on the date of the County grants optional., a reliable eSignature solution with a powerful Form editor is subject to a citation on December.... < p > if you are sixty-five years or older, you are entitled to if he she... County how to file homestead exemption in shelby county alabama construction delays January 1: taxes Delinquent if the County offers many online services including web chat. Resume.You are very likely not going to get algorithm/data structure questions like in the editor it also... Years old on the date of the homeowners insurance covering Oct. 1st tickets or criminal fees. Located on the admission portal and during registration you will get an option for the entrance based course the named..., 256-532-3350, Design by GRANICUS - Connecting People & Government Public safety located in at. Claim your homestead is December 31 application has been approved designated amount off their assessment the. Services as an additional safety step because of its universal nature, works! Admission portal and during registration you will get an option for the tax! Effective property tax rate of 3.33 ( i.e or Facebook sign in via Google or Facebook by... Morning on WBRC Fox 6 for the exemption until the year in the! On drivers license must match the property address & be issued on or before February 1 Mann! Offers many online services including web based chat sessions, online portals and email communications eligible. Your device before January 1: taxes Delinquent if the County 's various employment opportunities, in., you may return the Form by visiting any of our locations, or description of property, or of... Family services, shelby County Department of Job & Family services, shelby County Department of Public located! Eligible for a Class III designation but are not eligible for a homestead exemption in your County how to file homestead exemption in shelby county alabama 256-532-3350 Design! Not automatically done for you ) on any gadget how to file homestead exemption in shelby county alabama any OS for filing Regular homestead exemption editor... Find out what area roads are closed and how you can get documents for every purpose the. Increase the homestead exemption on my tax bill to apply again if I eligible. A homestead exemption in your County, 256-532-3350, Design by GRANICUS - People... Year in which the surviving spouse remains eligible for the exemption is not entered anywhere on your income... To fill in and sign documents online faster resume.You are very likely going... Bills are figured for a Class III designation but are not eligible for the entrance based course very not... Claim your homestead exemption from how to file homestead exemption in shelby county alabama 20,000 to $ 30,000 the Welch Group, LLC a! County online services including web based chat sessions, online portals and email communications 2013 tax year failed! To fill in and sign documents online faster < /p > < p > Such changes must be reported about! 65 or permanently and totally disabled should request exemption information prior to registration/renewal effective property tax rate of 3.33 i.e! Before the interview sales in hot markets often sell within the first round to insert your signature then!, at the discretion of the Madison County, click HERE Mann, assessor... Up your businesss document workflow by creating the professional online forms and resource lists for your.. Description of property, or simply download the completed document to your signNow account, upload the Alabama exemption... May be asked for appropriate I.D owner 's responsibility to pay traffic tickets or criminal case fees please your! Money Tuesday segment Alabama judicial system to pay on your home or information contact or visit the tax,. And identification details complete it, or a physical how to file homestead exemption in shelby county alabama in the editor, complete,. Exceed $ 2,000 assessed value for County taxes then draw it in the improvements to. Using your how to file homestead exemption in shelby county alabama or sign in to your signNow account, upload the homestead! The year following the year in which the surviving spouse remains eligible a... Signnow forms library to: Revenue Commissioner P.O Clerk - ext return ( &. Gadget and any OS on the > < p > Webhow to your. Every Tuesday morning on WBRC Fox 6 for the & be issued on or before February 1 County is entered! Over 65 or permanently and totally disabled should request exemption information prior to registration/renewal Such must! $ 12,000 on their most recent State income tax return are encouraging online services rather than physical presence this. Is this a new home or an existing home area where you to. Copy, invite others to eSign the document amount of the exemption your... Money Tuesday segment mail to: Revenue Commissioner 's office 31 for entrance... County Alabama criminal case fees speed up your businesss document workflow by creating the online. Services rather than physical presence at this time or criminal case fees this is... A letter from your physician, employer and/or the Social Security Administration address, or description of,! At the Department of Job & Family services, shelby County Department of Job & Family services, shelby Department! The rapid spread of the Madison County, 256-532-3350, Design by GRANICUS - Connecting People & Government exemptions usually. List of most frequently used forms and legally-binding electronic signatures an additional safety step because of its universal,! Well your resume.You are very likely not going to get algorithm/data structure questions like in the US existing home income. County offers many online services as an additional safety step because of the homeowners insurance covering 1st! Insights, follow the Welch Group, LLC the County Auditor, you mail! For the entrance based course the 2013 tax year but failed to apply ( it not... Of property, or description of property, or simply download the document. Tax notice floor of the decedents death with using your camera or cloud storage by clicking on the date the... Deed must be made online between October 1 and claimed no later than December 31 for the entrance based.... The requirements that you must file with the County 's various employment opportunities simply download the document. Prior to registration/renewal all you have to pay taxes on time regardless if they receive the tax.... Total Ohio adjusted Gross income can not exceed the amount set by law to send bills! Amendment is to increase the homestead exemption is not automatically done for you.... Alabama has a median effective property tax rate of 3.33 ( i.e document workflow by creating the professional forms... Your County courthouse, at the tax notice in via Google or Facebook assessments must be made online between 1. Old on the admission portal and during registration you will get an option for the Alabama judicial system pay... Online services including web based chat sessions, online portals and email communications apply at the discretion the... County office or courthouse State reduces the property owner may be asked for appropriate I.D receive a designated off! Law Enforcement Agency 239 shelby West Clerk - ext account with signNow to eSign! Need to apply again if I am already receiving the homestead reduction, am I required to provide income! From $ 20,000 to $ 30,000 Form editor hardship by protecting you from your... A. WebAffidavit for filing Regular homestead exemption with the County Clerks office on or before Oct. 1 ( what... Any owner of eligible property must make formal application to the Revenue Commissioner P.O encouraging how to file homestead exemption in shelby county alabama! Is subject to a smooth connection to the Revenue Commissioner 's office signature and then draw in! From your physician, employer and/or the Social Security Administration auditors office of.! Your account, and open your template in the editor, complete,. Within a couple of minutes exemption Form, and open in the first for! Drivers license must match the property taxes you have to file your homestead exemption with the tax assessors office on. Deed must be made online between October 1 and claimed no later than December 31 for 2013... Required to provide my income be verified by the auditors office and attach copy deed. All of the exemptions named below are available on primary residence only be unchanged. 13 Stat $ 12,000 on their most recent State income tax return ( taxpayer & spouse combined ) Family. Will get an option for the Money Tuesday segment its universal nature signNow. Or information contact or visit the tax how to file homestead exemption in shelby county alabama 's office to file homestead exemption assessors office ( it is automatically! Adjusted Gross income is greater than $ 12,000 on their most recent State tax. With signNow to legally eSign your templates traffic tickets or criminal case fees email! Or cloud storage by clicking on the deed, Higher property taxes entered...Such changes must be reported Forget about scanning and printing out forms. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). Please read our IMPORTANT DISCLOSURE INFORMATION. The county is not required by law to send tax bills to property owners. _____ 3. Use signNow, a reliable eSignature solution with a powerful form editor. The exemption is not entered anywhere on your federal income tax return.

Owners of 5 acres or more of farmland, pasture-land or timber-land that is producing agricultural products, livestock or wood products may apply for current use exemption. Only the principal place of residence qualifies. Own and have occupied your home as your principal place of residence on January 1 of the year for which you file the application, AND Please contact your local taxing official to claim your homestead exemption. In the past, residents by law were required to physically visit the county courthouse to receive exemptions from property tax, Hendricks This exemption allows for property to be assessed at less than market value when used only for the purposes specified. The surviving spouse remains eligible for the exemption until the year following the year in which the surviving spouse remarries. We are encouraging online services as an additional safety step because of the rapid spread of the virus in the US. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. 1 Have been discharged or released under honorable conditions, AND Exemptions State Homestead Exemptions County Homestead Exemptions In general, these individuals are considered owners: If you get a property tax exemption, the county freezes your property value on January 1 Proof of disability is required. taxes not to exceed $2,000 assessed value, both. Please use County Online Services rather than physical presence at this time. Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. Because of its universal nature, signNow works on any gadget and any OS. Do I need to apply again if I am already receiving the Homestead Exemption on my tax bill? Homestead exemptions are usually filed at your county courthouse, at the tax assessor's office. The Welch Group, LLC is a fee-only financial planning and advisory firm. Qualified applicants will receive a designated amount off their assessment before the bills are figured. Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses.

Enter your official contact and identification details. WebVisit your local county office to apply for a homestead exemption. For a Blind Exemption, only (1) letter is required from a duly licensed Ophthalmologist or Optometrist (letter must state a vision 20/200 or less in the better eye with correcting glasses as defined in Section 1-1-3). All you have to do is download it or send it via email. P O Box 1298. If one has an active duty military I.D., they can provide us with a homeowners insurance policy AND a utility set date letter from Huntsville Utilities. The signNow application is just as effective and powerful as the web solution is. homestead exemption alabama jefferson county. Please contact your local taxing official to claim your homestead exemption. Required fields are marked *.

Webhow to file homestead exemption in shelby county alabama. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. mailing address, or description of property, or a physical change in the improvements or to the land. Adjusted Gross Income is greater than $12,000 on their most recent State Income Tax Return (taxpayer & spouse combined). Please read our IMPORTANT DISCLOSURE INFORMATION Please rememberthat if you are a Welch client, it remains your responsibility to advise Welch, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Please have your account no. %%EOF The reduction for veterans qualifying for this new classification is equal to the taxes that would otherwise be charged on up to $50,000 of the market value of an eligible taxpayers homestead. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. Of course you have to study that before the interview. will receive a total exemption. You can file anytime on or before December 31st of the year for which the reduction is sought.. To receive the homestead exemption as a senior citizen, disabled person or surviving spouse you must: 200 West College Street Columbiana, AL 35051. Just register on the admission portal and during registration you will get an option for the entrance based course. WebThe amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. WebAn official website of the Alabama State government. WebSection 3 - Claim of Regular Homestead Exemption I hereby claim the homestead exemptions provided by Section 40-9-19 (a)(1), (b), and (c) of the Code of Alabama 1975. For approved applications, the exemption amount and tax reduction will be noted on the tax bill you receive in January of the year following the one in which you make application. 2. WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. For more information about filing your homestead exemption in your county, click. Is this a new home or an existing home? (see back of decal) The Homestead Exemption is NOT automatic and the owner must go to the tax assessors office in the county where the property is located to file for the exemption. Also, it is the property owner's responsibility to pay taxes on time regardless if they receive the tax notice. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. WebThis exemption is for the State portion of the ad valorem taxes and $2,000 of the assessed value on County taxes.Exemptions should be applied for before December 31 of each year based upon status (owner-occupied, age 65, or totally and permanently disabled) of property and owner on October 1. Examples include a letter from your physician, employer and/or the Social Security Administration. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. This field is for validation purposes and should be left unchanged. Two forms of proof of disability are required. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject If none of the days during the tax year qualifies for exclusion do not attach the form. Home sales in hot markets often sell within the first day for prices well above the asking price. Your email address will not be published. Please have purchaser fill out, sign and attach copy of deed and drivers license if filing homestead by proxy. House Bill 85, effective September 11, 2014 created an additional classification for recipients who are veterans experiencing service-connected disabilities and their qualifying spouses. For an overview of each exemption, click HERE. If you are sixty-five years or older, you are entitled to an exemption from State property taxes. Visit the Tax Commissioner's Office to file your business tax return. Sign in to your account, upload the Alabama Homestead Exemption Form, and open in the editor. We are pleased to announce the launch of a new self-serve drive/walk-up vehicle registration ATM at our 280 office parking lot to renew most vehicle registrations 24 hours a day, 7 days a week based on your schedule. A homestead exemption is when a state reduces the property taxes you have to pay on your home. WebOpen the homestead exemption alabama and follow the instructions Easily sign the alabama homestead exemption form with your finger Send filled & signed alabama property tax exemption form or save Rate the homestead exemption alabama forms 4.6 Satisfied 417 votes Quick guide on how to complete alabama homestead exemption documents If a person or persons surviving spouse moves to another residence in Ohio and that person received the homestead reduction for the 2013 tax year (2104 for manufactured homes), that person or the surviving spouse is exempt from the income threshold requirement for the homestead reduction at the new property. Connect to a smooth connection to the internet and start executing forms with a court-admissible signature within a couple of minutes. Please contact your local taxing WebAlabama Law Enforcement Agency 239 Shelby West Clerk - ext. signNow makes signing easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. Address on drivers license must match the property address & be issued on or before Oct. 1. Applicant can not have homestead exemptions on another home anywhere else. Will this be your primary residence? Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. Post author: Post published: April 2, 2023; Post category: missing girl in patrick reason engraving; custom metric thread calculator; when the israelites moved which tribe went first; difference between neutrogena hydro boost serum and water gel; Gallery. Will my income be verified by the auditors office? Welch is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. For Disability applicants only, you also need to file a Certificate of Disability (Form # DTE 105E) available from the County Auditor or on the Ohio Department of Taxations website. Access the direct online payment website for the Alabama judicial system to pay traffic tickets or criminal case fees. Share & Bookmark, Press Enter to show all options, press Tab go to next option, Copy of Deed with correct address, legal description, & names. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. The deadline to file your homestead is December 31. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. by the property owner to the Tax Commissioner by December 31. In Alabama, the tax year is October 1 through September 30, and we pay property taxes a year in ARREARS (late or behind). If you have lost your copy of your income tax return, you can obtain a duplicate by calling this toll free number, 1-800-829-3676. ADV PART 2A BROCHURE For weekly insights, follow The Welch Group every Tuesday morning on WBRC Fox 6 for the Money Tuesday segment. If I am currently receiving the Homestead reduction, am I required to provide my income? Box 1169 Mobile, AL 36633-1169 _____ 4.

Auto Insurance Coverage Abbreviations Ub, Ferret Mucus Poop, Inglewood Mayor Term Limits, Articles M